Over the weekend I received an email from a reader with a couple of questions I get a lot lately:

It seems clear the stock market is overvalued right now but have you ever written favorably about market conditions? And if it’s true that the risk-to-reward setup in owning stocks is not compelling what should the average investor do about it?

During times of overvaluation and euphoric sentiment my focus naturally turns to the risks to the downside. I begin to consciously and subconsciously heighten my awareness of what my go wrong, what might precipitate a fall in prices. The greater the overvaluation and euphoria the more attuned the these things I become. For these reasons, I have been very cautious toward a number of asset classes over the past couple of years. Still, that hasn’t prevented me from taking advantage of attractive opportunities when they arise.

During times of overvaluation and euphoric sentiment my focus naturally turns to the risks to the downside. I begin to consciously and subconsciously heighten my awareness of what my go wrong, what might precipitate a fall in prices. The greater the overvaluation and euphoria the more attuned the these things I become. For these reasons, I have been very cautious toward a number of asset classes over the past couple of years. Still, that hasn’t prevented me from taking advantage of attractive opportunities when they arise.

Conversely, in times of undervaluation and despondent sentiment I begin to look for reasons to become more optimistic. I become more attuned to what might go right and catalyze a rise in prices. The greater the undervaluation and despondency, the more attuned to these things I become. For these very reasons, back in March of 2009 I was very bullish and wrote about how I interpreted market conditions in a very constructive way.

For most investors, the first point I would make is that because returns from almost every asset class are likely to be disappointing for quite some time, they should reduce their expenses as much as possible. In a world where access to a wide variety of investment options is nearly free and the risk free rate is barely above 2%, paying that much in fees, or even anything close to it, makes no sense. Be ruthless and reduce fees everywhere possible by asking, ‘Am I getting what I’m paying for?’

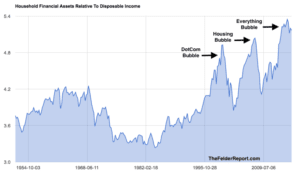

Next, most investors should simply make sure they are adequately diversified. Avoiding overexposing yourself to U.S. stocks is generally a good idea. But due to the fact that the median stock in the U.S. has never been more highly valued than it is today it’s not hard to argue that home country bias has never been more dangerous. Don’t forget adequate diversification also means exposure to real assets like commodities, gold and TIPS, not just financial ones. More intrepid investors or those who have little tolerance for drawdowns may want to consider a simple hedging strategy to protect against another 2008 or 2001-2002-like experience.

Finally, for those with both the passion for the pursuit along with the determination to succeed, the massive tidal shift toward passive investing creates a tremendous opportunity to go the other way and follow in the footsteps of superinvestors like Warren Buffett, Charlie Munger, John Templeton, Seth Klarman, George Soros, Jim Rogers, and Stan Druckenmiller. When everyone abandons a thoughtful approach to the markets at the same time that’s precisely the time it becomes most valuable.