Jeremy Siegel, of Stocks For The Long Run fame, was on CNBC this morning:

“I think we’re in the first inning of shifting to dividend-paying stocks,” the finance professor at the University of Pennsylvania’s Wharton School said Tuesday on CNBC’s “Trading Nation.” Even though the Fed may raises [sic] rates this year, “investors are becoming convinced they’re not going to be able to rely on CDs, their bank accounts, or even bonds as a source of income,” and may thus determine that “maybe they’d better turn to stocks,” he said.

Let me get this straight: The professor claims that investors are only just beginning to realize that bonds and cash have no yield thus there is no alternative to putting their money into dividend-paying stocks? In other words, we are only in the “first inning” of TINA (there is no alternative – to stocks)?

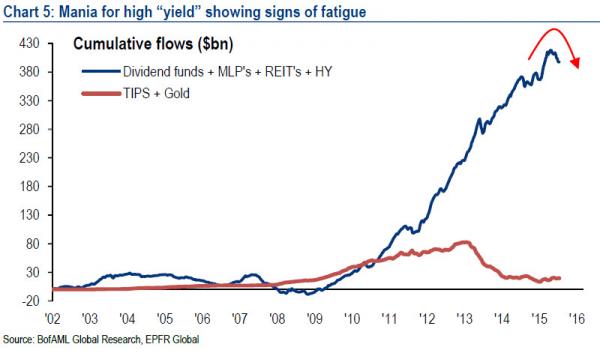

Can someone please do me a favor and show Prof. Siegel the charts below? Because it seems to me investors have been reaching for yield for several years now as a direct response to 7 years of ZIRP (zero interest rate policy).

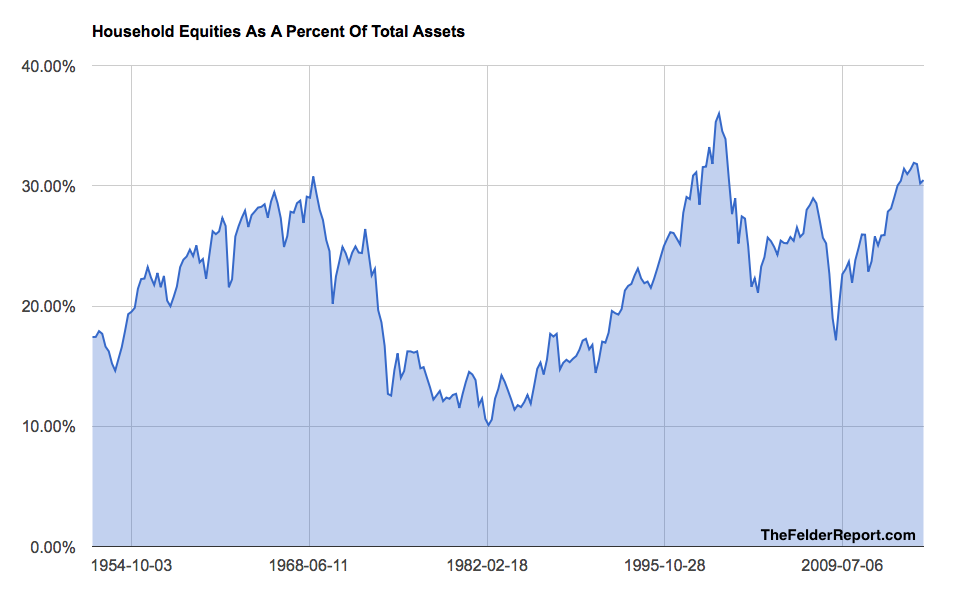

And after 7 years of reaching for yield, investors now have one of their largest allocations to stocks in history. Only at the height of the dotcom bubble did households have a greater portion of their total financial assets tied up in equities than they did recently.

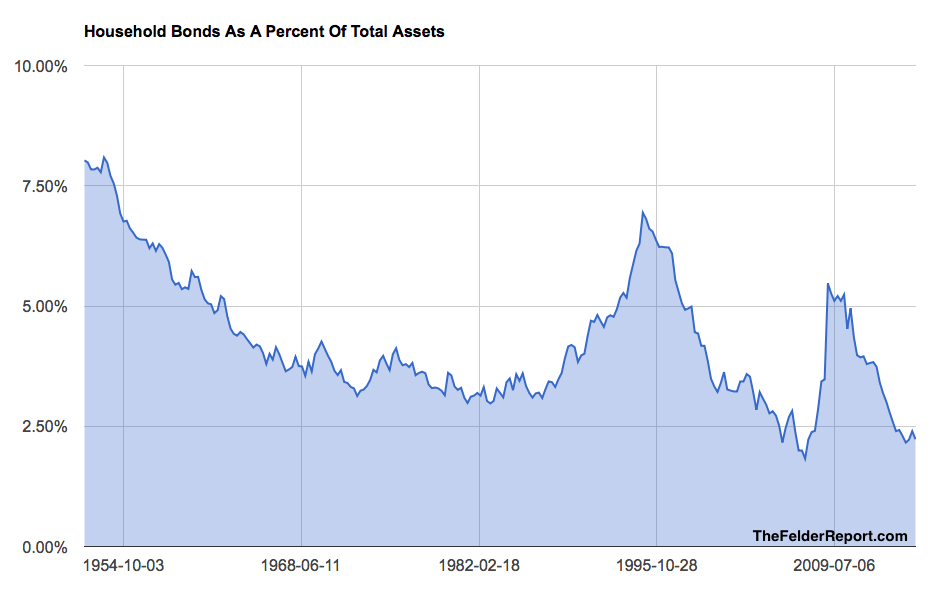

The difference between today and back then is their allocation to bonds. While investors have ramped up their exposure to stocks, they have shifted almost entirely out of bonds. Even during the dotcom mania investors maintained nearly twice the current allocation to fixed income.

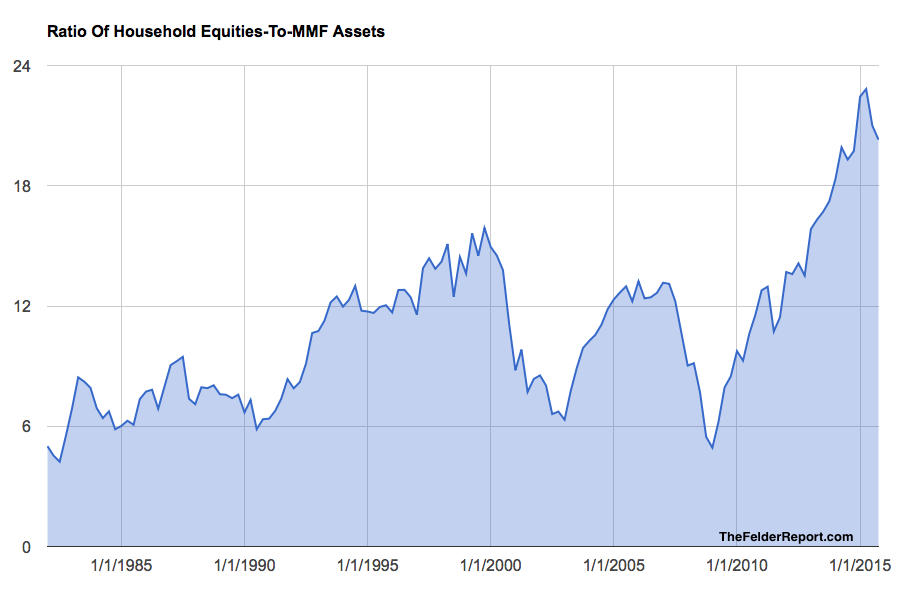

Finally, when you look at the ratio of equities to money market fund assets it becomes instantly obvious that investors have been embracing the concept of TINA for quite a long time now and to a degree never seen before.

So my question for Prof. Siegel is this: If investors have already shifted entirely out of bonds and money market funds, where the hell is this new, massive shift into stocks going to come from? Perchance, you’re just feeling a bit too bullish once again?

On a final note, this large-scale embracing of TINA could very well be the greatest sign of confidence in the stock market we have ever seen. And isn’t that precisely the psychological definition of a mania?

This Might Be The Most Extreme Stock Market Euphoria We Have Ever Seen